Finance

7. Finance

The Finance module is your central hub for all financial tracking. It consolidates income, expenses, deposits, and payment activity across every booking and property — giving you a complete picture of your portfolio's financial health.

The module is organized into several tabs, each focused on a specific financial area.

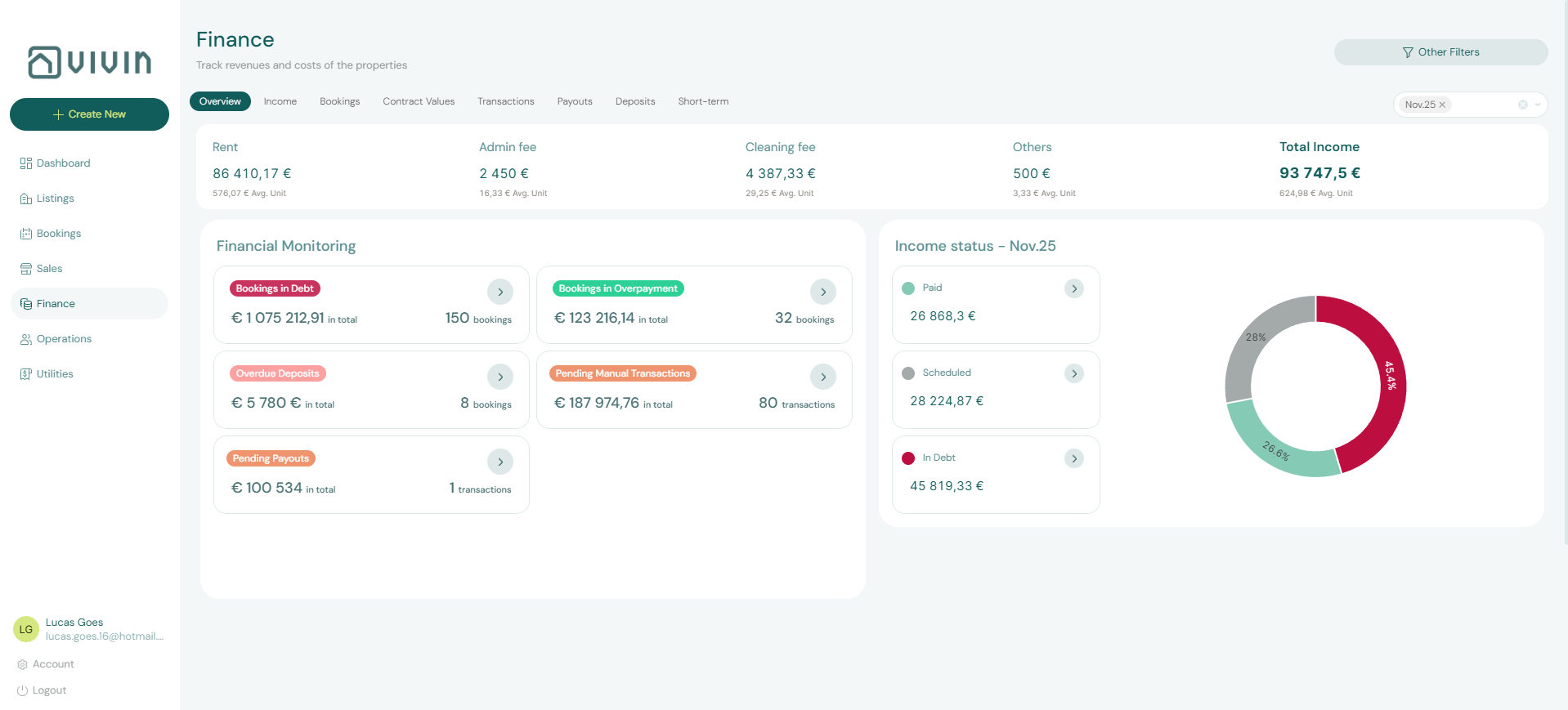

7.1. Overview Tab

The Overview tab provides a high-level financial dashboard for your entire portfolio. At the top, you will find filter controls to refine the data by property, date range, and other criteria.

The overview displays your income status across bookings — which payments have been received, which are pending, and which are overdue:

Use the Overview tab as your daily financial health check. Properties or bookings with large outstanding balances are visible here, allowing you to prioritize follow-up.

7.2. Bookings Tab

The Bookings tab shows the payment status of every booking in your portfolio. Each row shows:

- Tenant and booking information

- Expected amount (total scheduled charges for the period)

- Received amount (total payments collected)

- Outstanding balance (the difference)

- Payment status (Paid, Partial, Overdue, Pending)

This tab is essential for collections management — quickly identifying which tenants owe money and how much.

Use the Sort By Debt option to surface the bookings with the highest outstanding balances first.

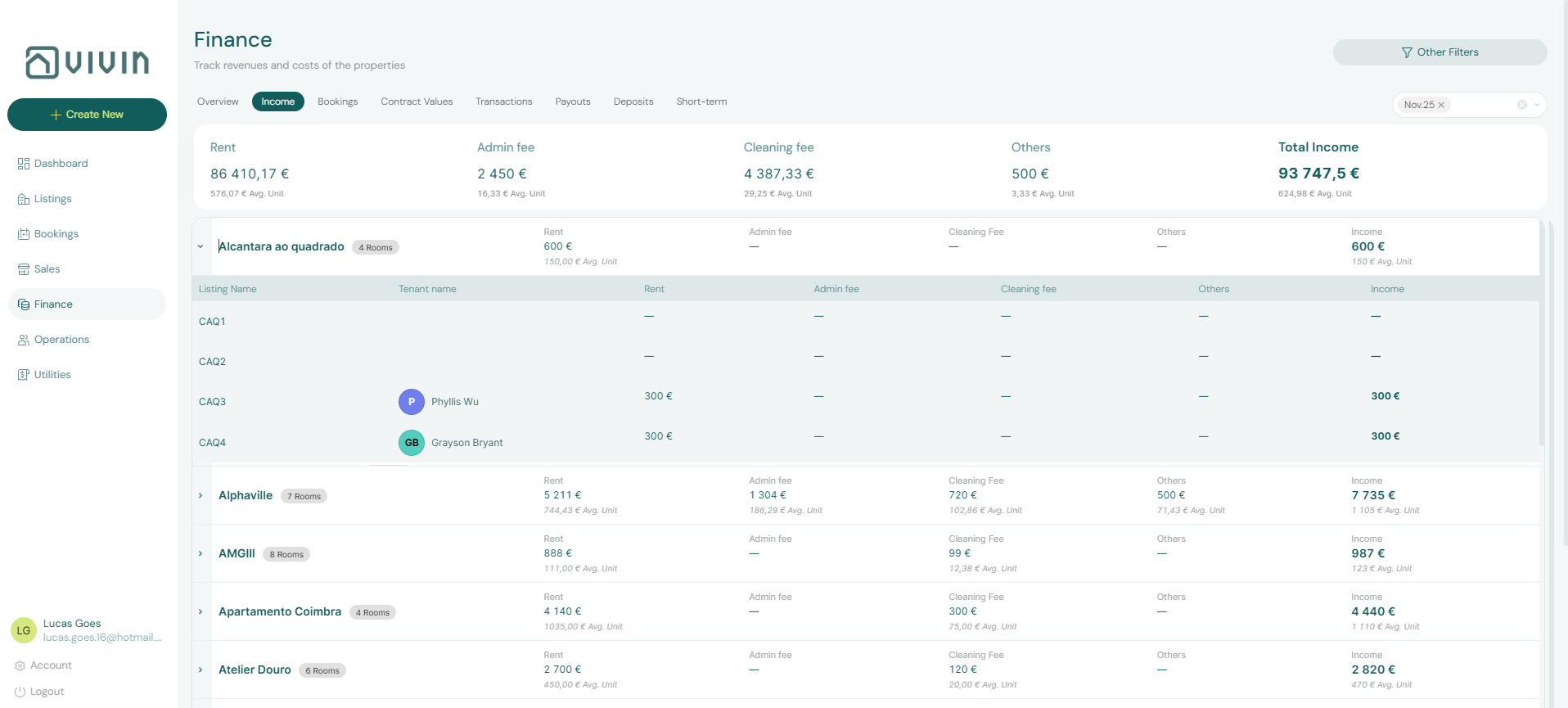

7.3. Income Tab

The Income tab provides a detailed breakdown of all incoming revenue. You can filter by property, date range, and payment type.

The data can be grouped by property, giving you a clear view of which properties are generating the most revenue:

Use this tab to:

- Verify that monthly rent is being collected for all active bookings

- Identify months with lower-than-expected income

- Generate revenue reports for property owners

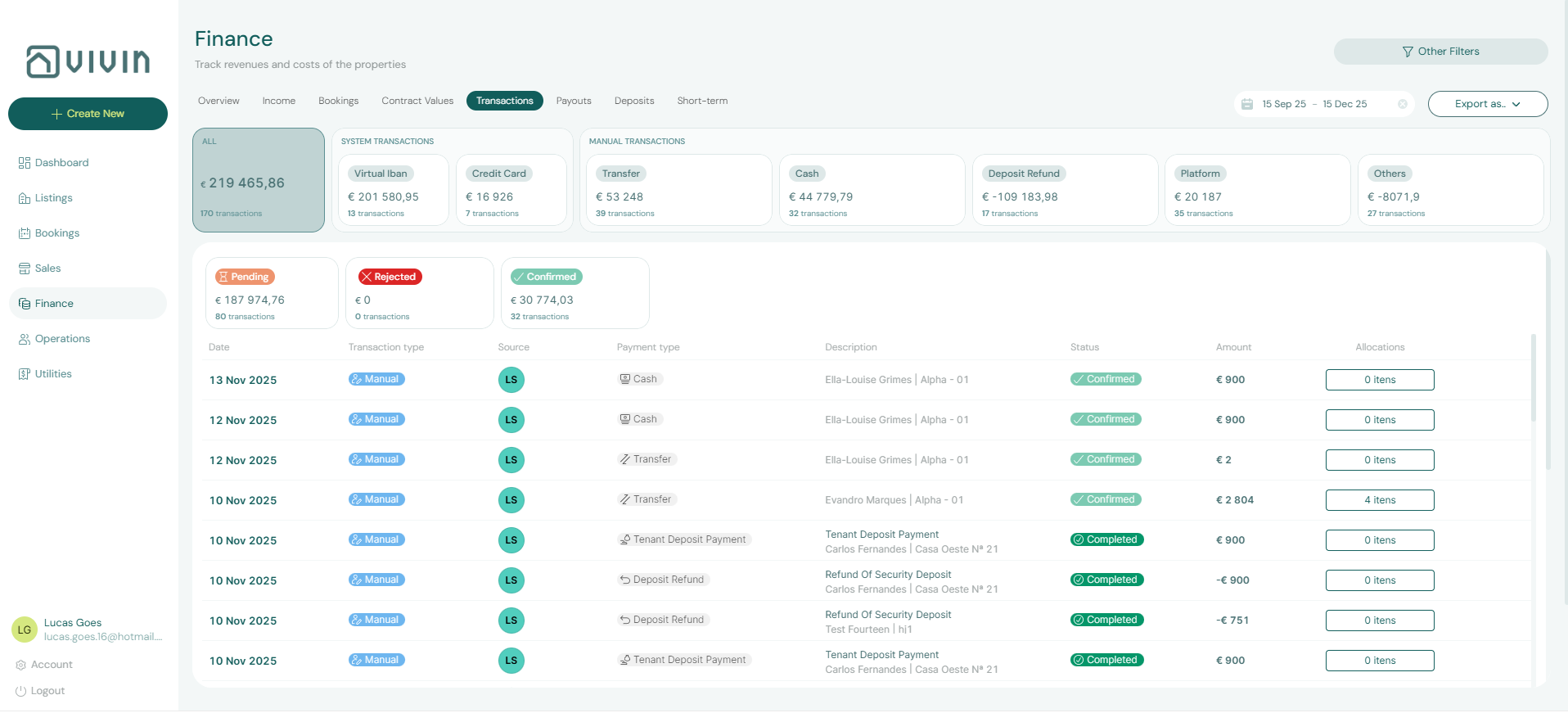

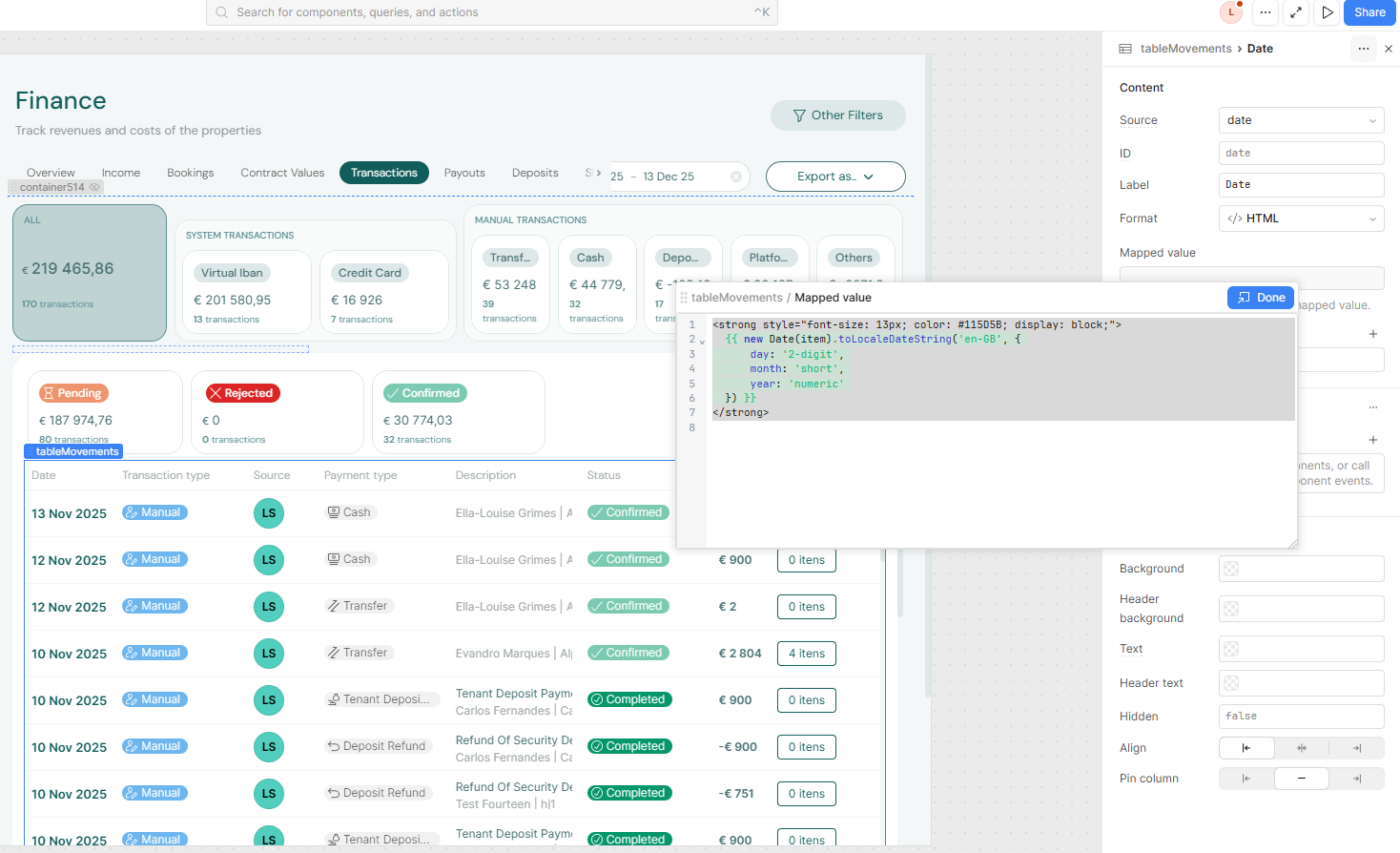

7.4. Transactions Tab

The Transactions tab is a detailed ledger of every individual payment received. Unlike the Bookings tab (which shows aggregated status), this tab shows each payment event individually.

Each row shows:

- Payment date

- Booking and tenant

- Amount received

- Payment type (Rent, Deposit, Fee, etc.)

- Allocation — which scheduled charge this payment was applied to

This tab is useful for reconciliation — cross-checking received payments against your bank records.

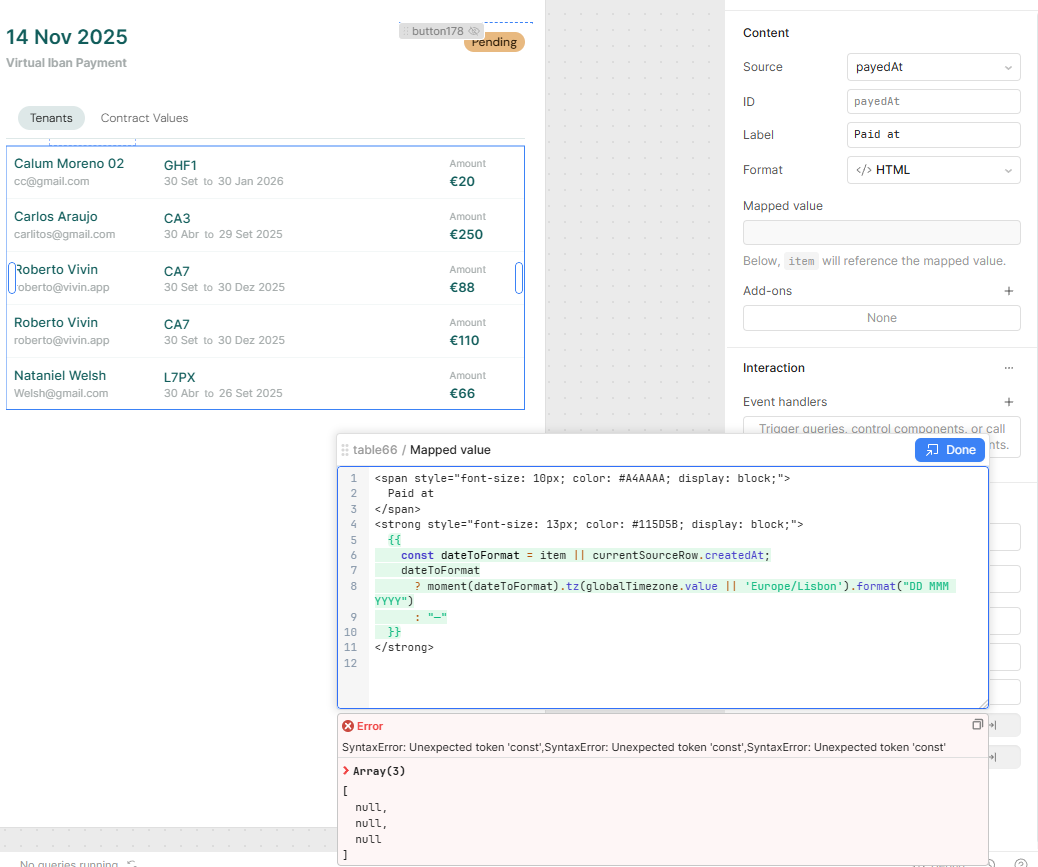

7.5. Incoming Payments Tab

The Incoming Payments tab manages the process of recording and verifying payments received from tenants. When a payment arrives, it is logged here with its details before being allocated to the appropriate scheduled charge.

Key columns include:

- Contract Values — the scheduled payment this incoming payment covers

- Paid At — the date the payment was received

Ensure the Paid At date is set correctly. An incorrectly set date causes the payment to appear in the wrong period in financial reports. If you notice a payment is showing up in the wrong month, this is the field to check:

After correcting the date, the payment will appear in the right period:

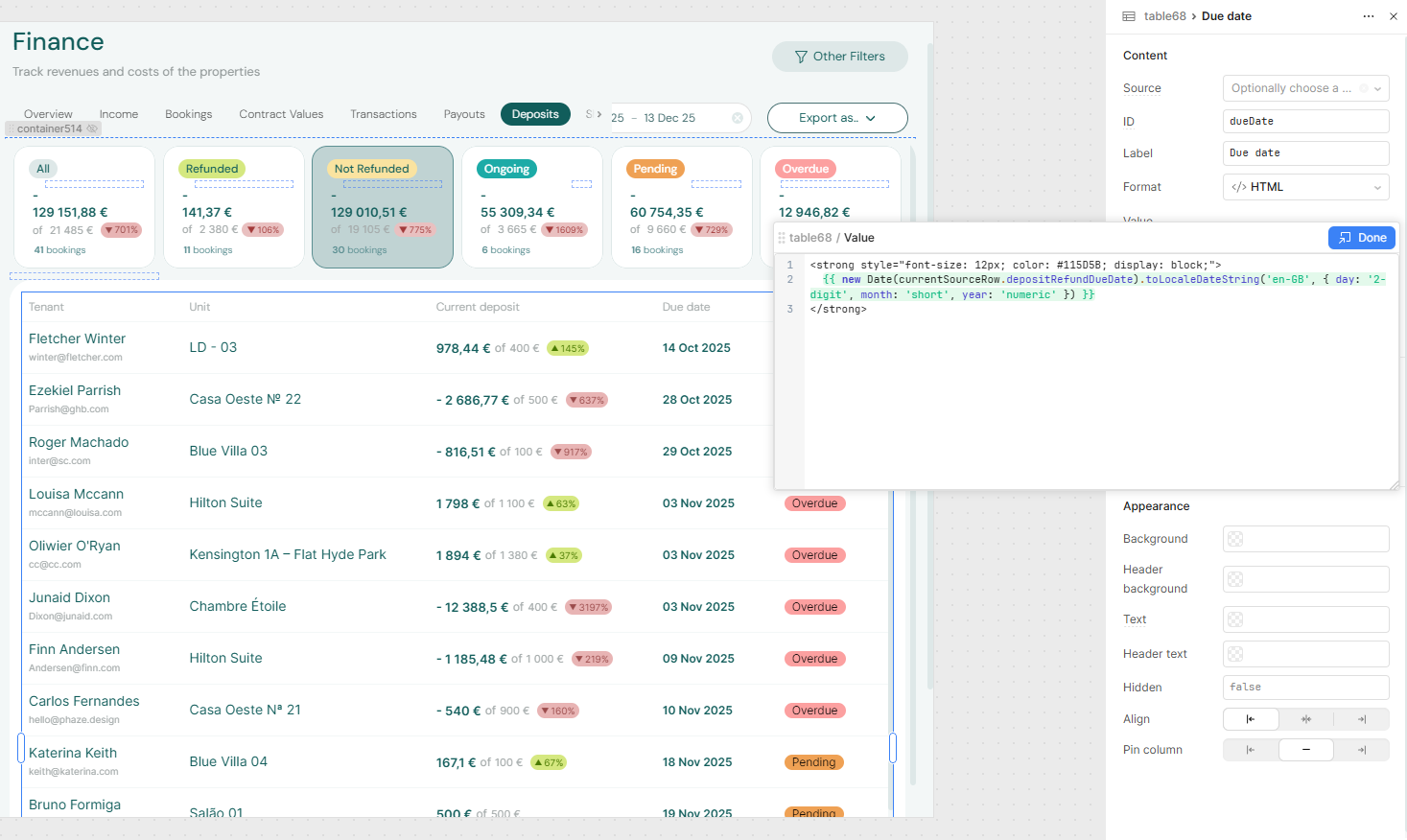

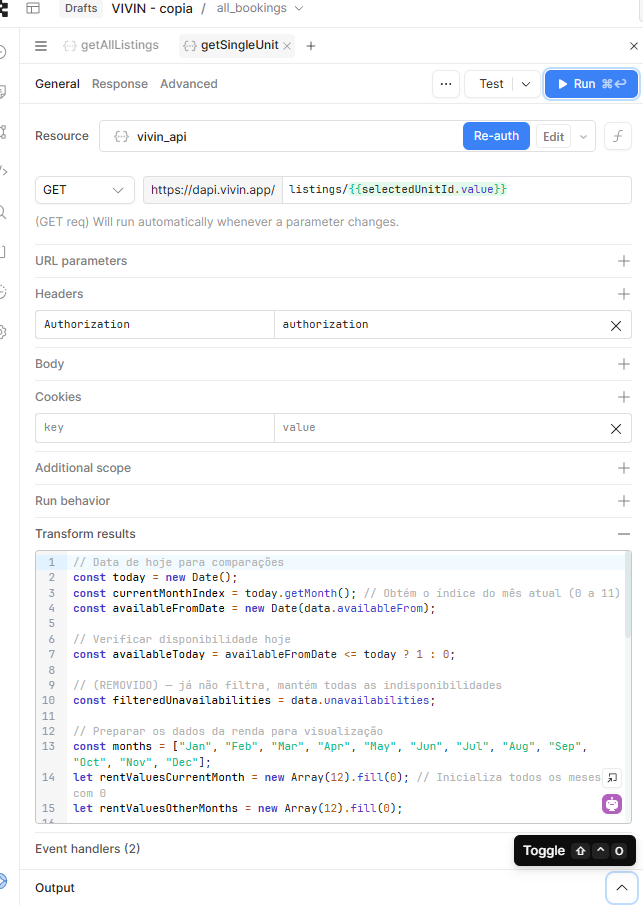

7.6. Deposits Tab

The Deposits tab tracks security deposits across all bookings. It shows the current status of each deposit:

| Status | Description |

|---|---|

| Received | Deposit collected from the tenant at move-in |

| Returned | Deposit fully refunded to the tenant at move-out |

| Retained | Deposit kept due to damages or outstanding charges |

| Partially Returned | Part of the deposit returned, part retained |

When a tenant moves out, use this tab to:

- Record any deductions for damages (with a description)

- Initiate the deposit return for the remaining amount

- Mark the deposit as fully resolved

The Finance module records the decision on deposit deductions and returns, but the actual bank transfer to the tenant is handled outside the platform. Vivin tracks what was decided, not the bank transfer itself.

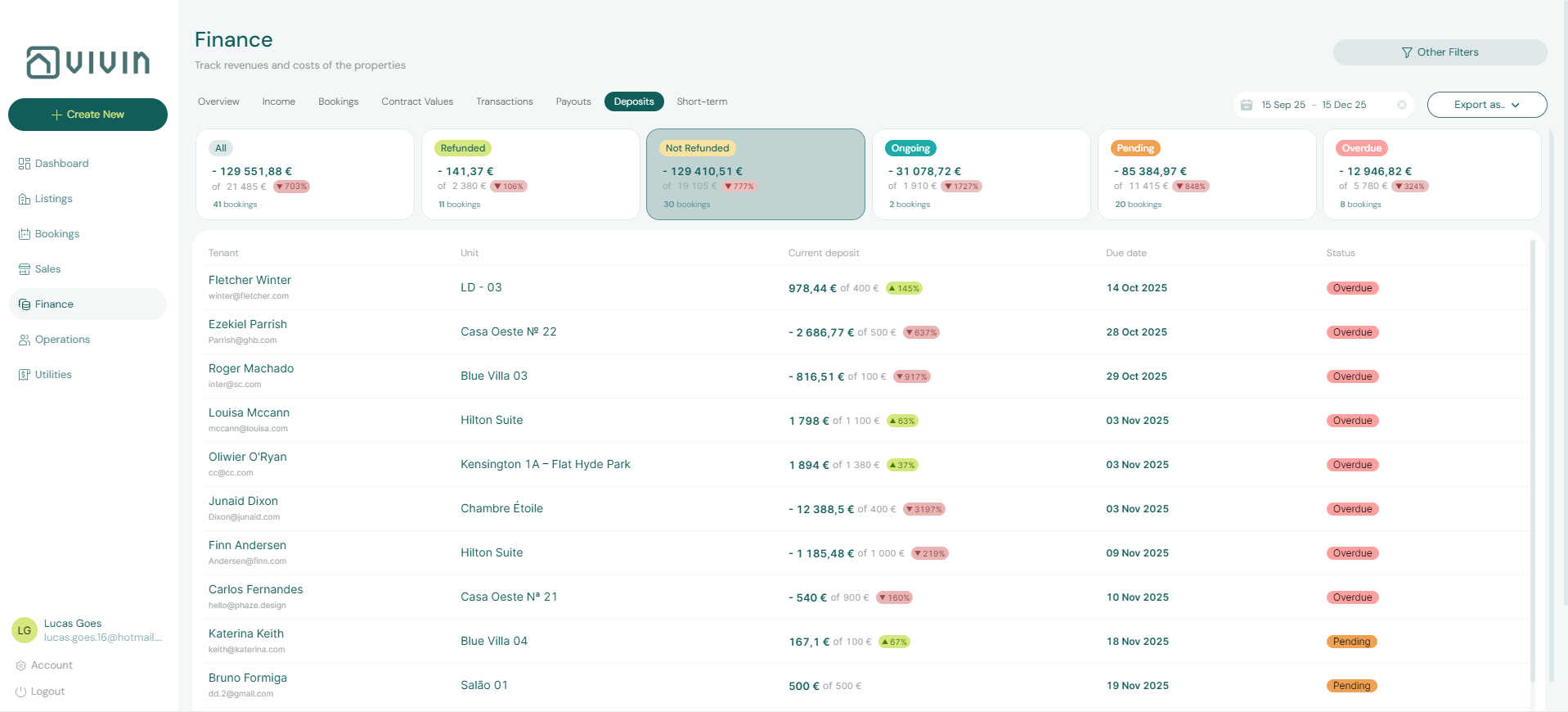

7.7. Short-Term Tab

The Short-Term tab provides reporting for short-term rentals (e.g., Airbnb stays). It displays transaction-level data formatted for the short-term context, showing nightly rates, platform fees, and net revenue per booking.

Use this tab to reconcile your Airbnb or Booking.com payouts against what the system has recorded.

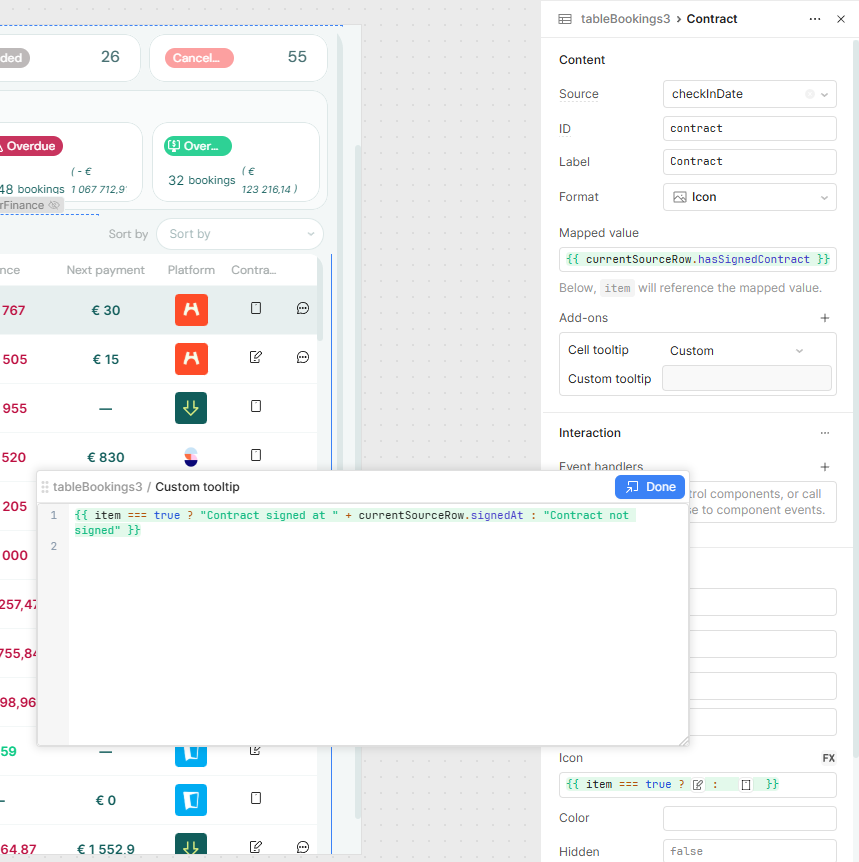

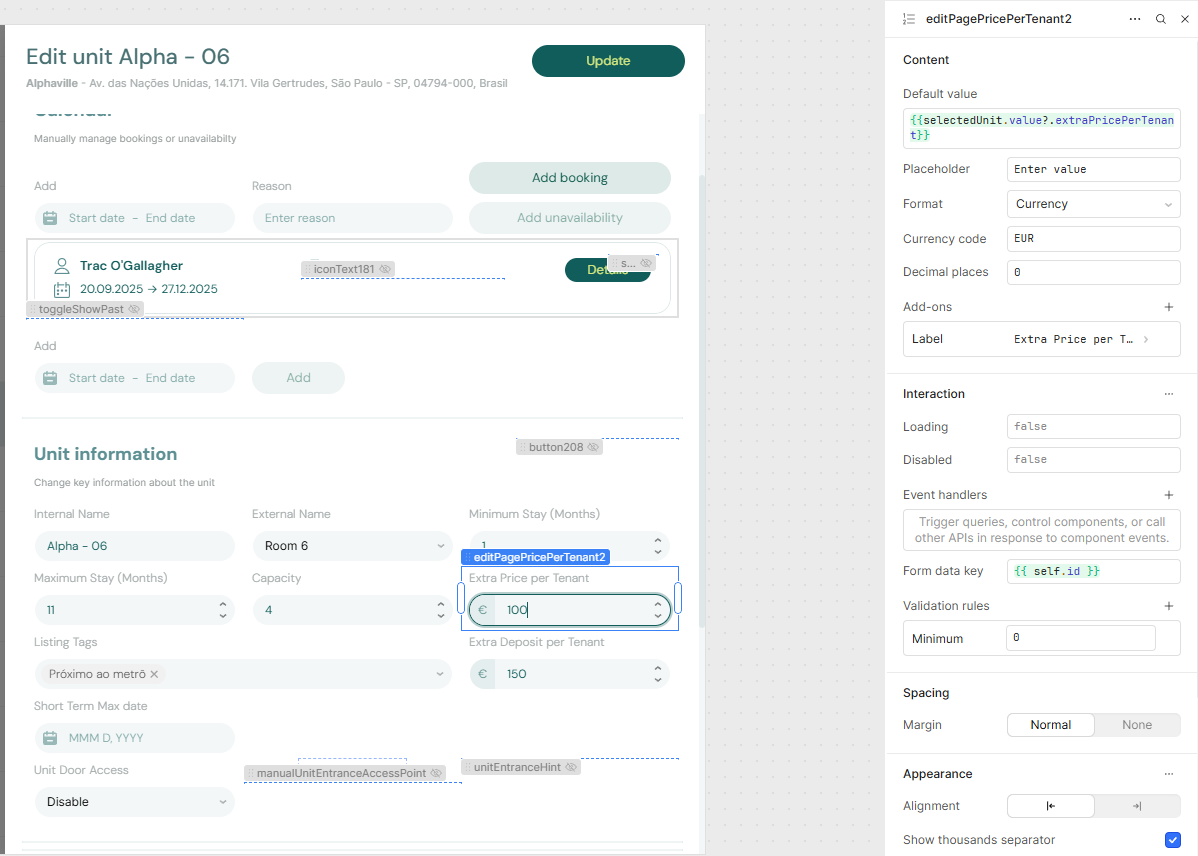

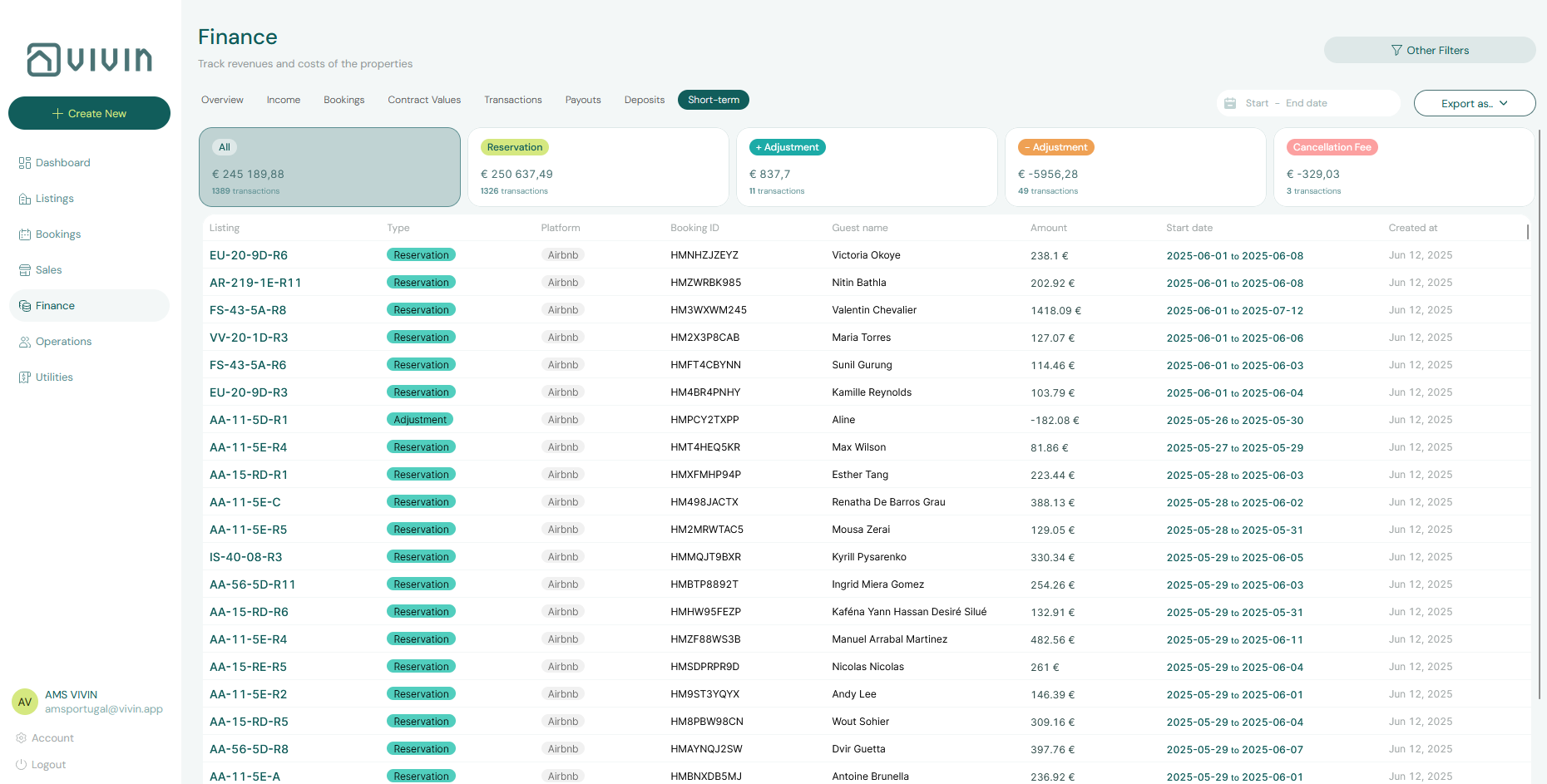

7.8. Contract Values Tab

The Contract Values tab shows a summary of all scheduled charges across all bookings — the "expected" side of your financial picture. This is the complete list of what tenants are contractually obligated to pay.

Use this tab alongside the Transactions tab to identify discrepancies: if a charge appears in Contract Values but has no matching transaction, the payment has not been received.

7.9. Payments Tab

The Payments tab shows all payment records with their mapped values — connecting scheduled charges to the actual payments received.

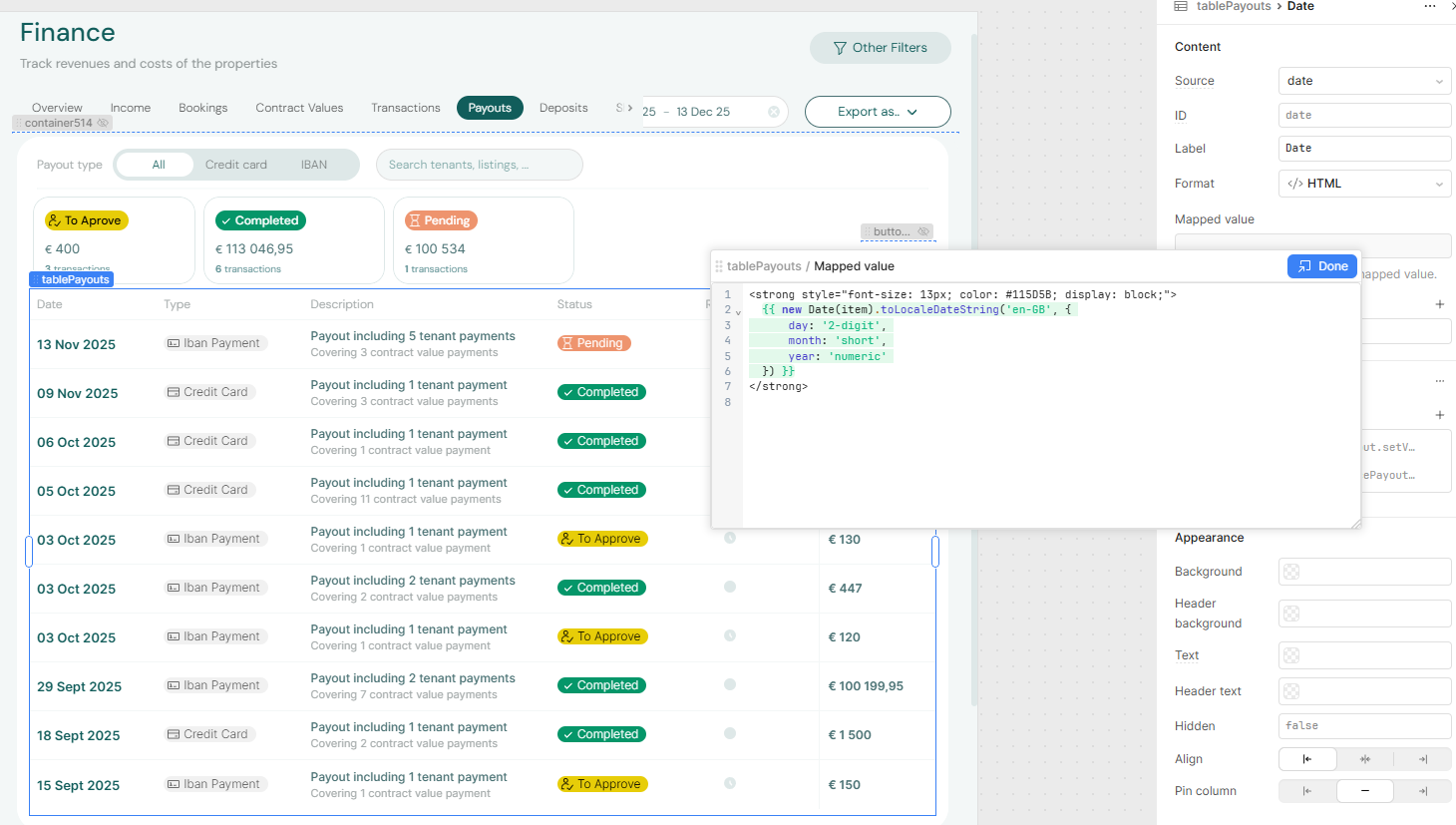

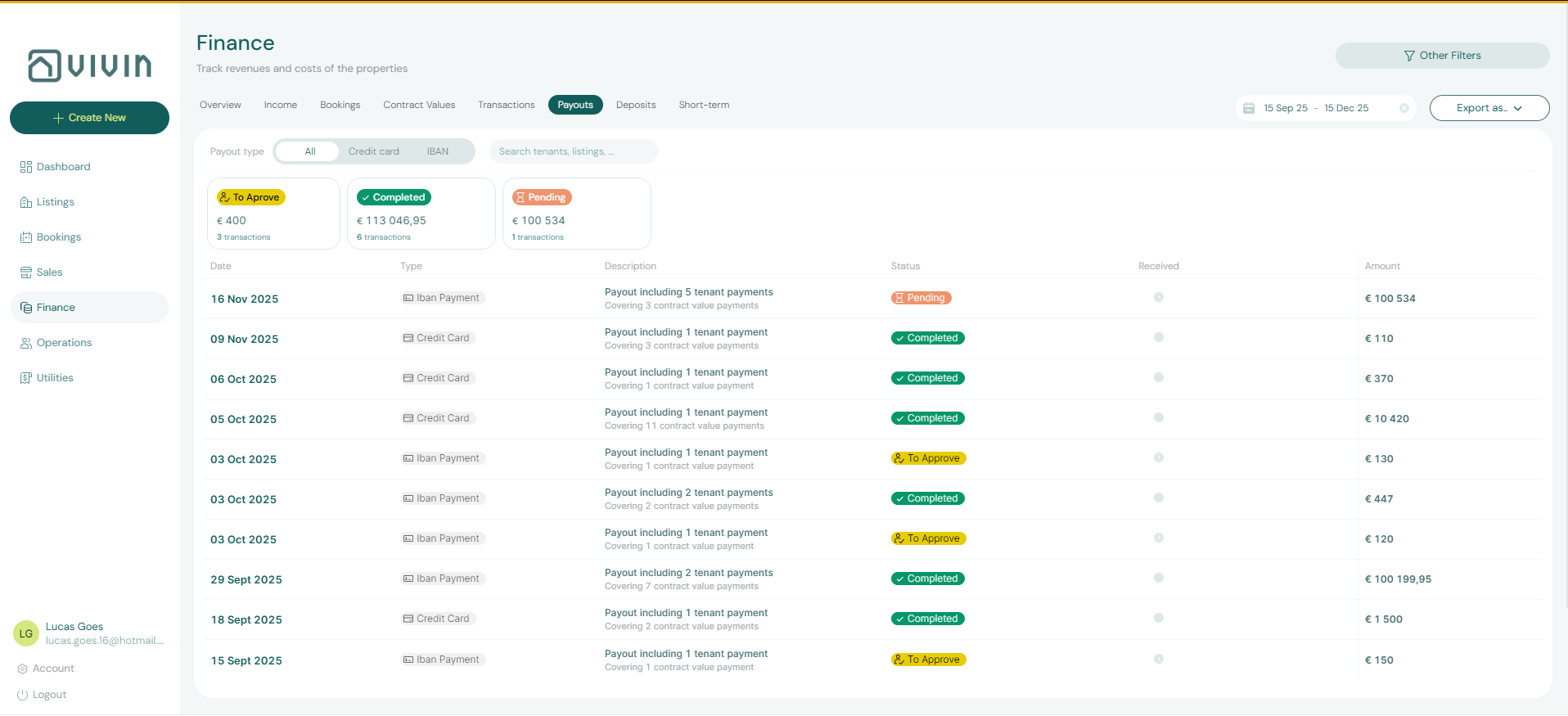

7.10. Payouts Tab

The Payouts tab tracks outgoing payments from your company to property owners. When you need to distribute revenue to an owner, this is where you record and track those transfers.

Each payout record includes:

- Owner name and associated property

- Amount

- Date

- Status (Pending, Paid)

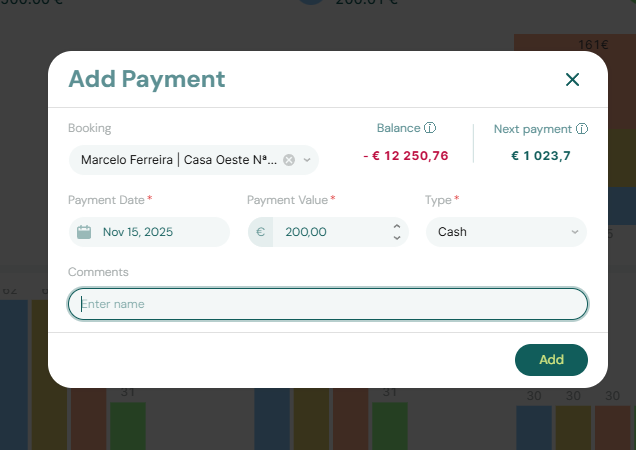

7.11. Adding Payments

To manually record a payment received from a tenant, click Add Payment within the Finance module or from the booking's Transactions tab.

In the modal, specify:

- Booking — which booking this payment is for

- Amount received

- Payment date

- Payment method

- Notes (optional)

The system automatically allocates the payment to the oldest outstanding scheduled charge. You can adjust the allocation if needed.

7.12. Key Business Rules for Finance

-

Payments are allocated automatically. When a payment is recorded, the system applies it to the oldest outstanding charge first. Overpayments become credits toward future charges.

-

Deposit status is tracked, not transferred. The Finance module records deduction and return decisions, but the actual bank transfer to the tenant is handled externally.

-

Contract values are fixed at booking creation. Scheduled charges reflect the terms in place when the booking was created. Property setting changes do not retroactively alter existing schedules.

-

Short-term and long-term reports are separate. The Short-Term tab is optimized for nightly-rate stays; all other tabs are optimized for monthly rental agreements.

-

A scheduled charge is only "Paid" once allocated. A charge in the Contract Values tab remains outstanding until a matching incoming payment has been recorded and allocated to it.